This piece was originally posted on the author's blog, Flip Chart Fairy Tales

Starting tonight, BBC Two is running a series called Britain’s Forgotten Slave Owners. It is based on research by University College London which found that Britain had 46,000 slave owners in 1833, the year slavery was abolished in the British Empire. All are clearly identified in the records of the compensation claims, and you can even see whether any of your ancestors were involved.

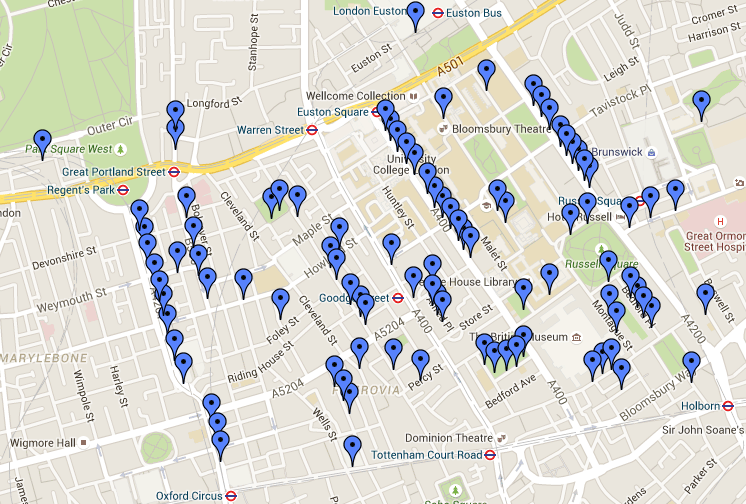

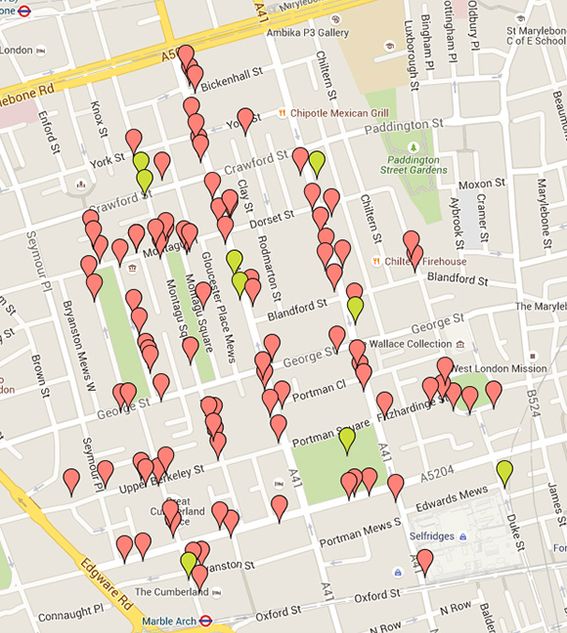

What has shocked many people is the sheer scale of slave ownership revealed by this research. It wasn’t just a few rich plantation owners. The wealthier middle-classes were in on it too. In those days, a lot of central London was still residential and the addresses of the slave owners are marked on maps produced by UCL. In the well-to-do areas of Fitzrovia and Marylebone, slave ownership was widespread.

Addresses in London's Fitzrovia where the recipients of slave compensation once lived:

Addresses in London's Marylebone area where the recipients of slave compensation once lived:

Should we be surprised by this? Given the number of British possessions in the Caribbean, their role in colonial trade and the importance of slavery to their economies, it would be astonishing if those who had money to invest didn’t put at least some of it into enterprises built on slavery. People in Britain are shocked by this is because British slavery is something we don’t really talk about. We prefer to think of it as something that happened "over there."

When he was elected president, Abraham Lincoln’s initial aim was to confine slavery to the southern states. Events overtook him but, after abolition, the American entertainment industry succeeded in placing the blame on this part of the country. Thanks, largely, to the proliferation of American books and films on the subject, people tend to have a stylised view of transatlantic slavery. The two enduring images are the slave ships and the cotton plantations of the American Deep South.

But this is like reading the first and last chapters of a book. The shipping of Africans to the Americas, initially by the Portuguese, is the start of the story. The great plantations of Alabama and Mississippi were its final phase. By the time the cotton economy boomed, the transatlantic trade was over. In between, there were 300 years when most slaves were put to work growing rice, tobacco, coffee and, of course, sugar. Many of those slaves were in what became the northern states of the USA and in British possessions in the Caribbean.

Even when we discuss Britain’s involvement in slavery, we like to put a geographical boundary around it. Just as Americans like to see it as a Southern thing, we point to the grand buildings of Bristol, Liverpool and Glasgow as legacies of the slave trade. The UK release of 12 Years a Slave in 2014 kicked off a new round of breast-beating as our west-facing ports were reminded of their shameful past.

Now, though, thanks to the UCL research, we know that people all over the country profited from the slave trade. Many of them did not own land. Their slaves were managed by someone else and hired out to the plantations. The financialisation of the slave trade is a subject that has received very little attention but it enabled thousands of people who would never visit a plantation, let alone wield a whip or give an order, to invest in and profit from slavery. Small investors in the UK provided the expansion capital for the slave-owners and received handsome profits in return.

The financialisation of slavery reached its peak in the early 19th century. It enabled the rapid development of the Deep South’s cotton economy. The demand for cotton was increasing but the planters needed investment to get them going. In a detail that perhaps a lot of people missed, the plantation owners in 12 Years a Slave refer to mortgages on their slaves. They borrowed money, using their slaves as collateral, to finance their expansion.

Edward E. Baptist of Cornell University, author of The Half Has Never Been Told (HTSunny Singh) explains how this finance was raised:

"The cotton and slave trades were the biggest businesses in antebellum America, and then as now, American finance developed its most innovative products to finance the biggest businesses.

In the 1830s, powerful Southern slaveowners wanted to import capital into their states so they could buy more slaves. They came up with a new, two-part idea: mortgaging slaves; and then turning the mortgages into bonds that could be marketed all over the world."

Does something about that sound familiar? It should do.

"The financial product that such banks as Baring Brothers were selling to investors in London, Hamburg, Amsterdam, Paris, Philadelphia, Boston, and New York was remarkably similar to the securitised bonds, backed by mortgages on US homes, that attracted investors from around the globe to US financial markets from the 1980s until the economic collapse of 2008.

[M]ortgage-backed securities shifted risk away from the immediate originators of loans onto financial markets while promising to spread out and thus minimize the consequences of individual debtors’ failures. Investors who purchased latter-day mortgage-backed securities planned to share in streams of income generated by homebuyers’ mortgage payments.

Likewise, the faith bonds of the 1830s generated revenue for investors from enslavers’ repayments of mortgages on enslaved people. This meant that investors around the world would share in revenues made by hands in the field. Thus, in effect, even as Britain was liberating the slaves of its empire, a British bank could now sell an investor a completely commodified slave: not a particular individual who could die or run away, but a bond that was the right to a one-slave-sized slice of a pie made from the income of thousands of slaves."

The slave-backed securities of the early 19th century worked in the same way as the mortgage-backed securities of the early 21st. They spread the risks and provided a means by which capital from all over the world could be channelled into the Deep South. This also meant that, even after abolition, British investors could still profit from the slave trade. They no longer owned slaves. Instead, they owned slave-based derivatives; financial instruments made up of mortgages on enslaved people.

I couldn’t find any information on the extent of British investment in slave-backed securities but the involvement of Baring Brothers in the design and marketing of these products suggests that there must have been considerable demand in Britain. (This was also, incidentally, the trade that took Lehman Brothers from Alabama cotton broker to Wall Street finance house, giving the bank’s history a fascinating symmetry.) Even after emancipation, then, British investors were still profiting from the slave trade. As, too, were investors in other parts of Europe. Even countries like Germany, which had little direct involvement in slavery, provided finance through these bonds.

The financialisation of slavery led to its industrialisation. The cotton plantations were much bigger than those of the old Upper South. From 1831 to 1837 cotton production almost doubled. The demand for labour drove a massive transfer of slaves from the North and Upper South to the Deep South. Some historians calculate that twice as many people were sold south as were shipped to North America in the transatlantic trade. Even after abolition, through their slavery bonds, 19th century British investors financed as much misery as their ancestors did.

This was no cover up though. None of the information has been kept secret. Because of the financialisation of slavery, there are detailed records available on production, management and ownership. The UCL team and Edward Baptiste simply went looking where no-one else had. It is convenient to put a geographic boundary around slavery and restrict it to the masters and overseers in the the Deep South and the Caribbean, or the captains of slave ships from Bristol and Liverpool. But it could not have happened on the scale it did without investment from the northern US states and Europe. Evidence of this widespread involvement in the slave trade was there all along. We just chose not to look for it.

Starting tonight, BBC Two is running a series called Britain’s Forgotten Slave Owners. It is based on research by University College London which found that Britain had 46,000 slave owners in 1833, the year slavery was abolished in the British Empire. All are clearly identified in the records of the compensation claims, and you can even see whether any of your ancestors were involved.

What has shocked many people is the sheer scale of slave ownership revealed by this research. It wasn’t just a few rich plantation owners. The wealthier middle-classes were in on it too. In those days, a lot of central London was still residential and the addresses of the slave owners are marked on maps produced by UCL. In the well-to-do areas of Fitzrovia and Marylebone, slave ownership was widespread.

Addresses in London's Fitzrovia where the recipients of slave compensation once lived:

Addresses in London's Marylebone area where the recipients of slave compensation once lived:

Should we be surprised by this? Given the number of British possessions in the Caribbean, their role in colonial trade and the importance of slavery to their economies, it would be astonishing if those who had money to invest didn’t put at least some of it into enterprises built on slavery. People in Britain are shocked by this is because British slavery is something we don’t really talk about. We prefer to think of it as something that happened "over there."

When he was elected president, Abraham Lincoln’s initial aim was to confine slavery to the southern states. Events overtook him but, after abolition, the American entertainment industry succeeded in placing the blame on this part of the country. Thanks, largely, to the proliferation of American books and films on the subject, people tend to have a stylised view of transatlantic slavery. The two enduring images are the slave ships and the cotton plantations of the American Deep South.

But this is like reading the first and last chapters of a book. The shipping of Africans to the Americas, initially by the Portuguese, is the start of the story. The great plantations of Alabama and Mississippi were its final phase. By the time the cotton economy boomed, the transatlantic trade was over. In between, there were 300 years when most slaves were put to work growing rice, tobacco, coffee and, of course, sugar. Many of those slaves were in what became the northern states of the USA and in British possessions in the Caribbean.

Even when we discuss Britain’s involvement in slavery, we like to put a geographical boundary around it. Just as Americans like to see it as a Southern thing, we point to the grand buildings of Bristol, Liverpool and Glasgow as legacies of the slave trade. The UK release of 12 Years a Slave in 2014 kicked off a new round of breast-beating as our west-facing ports were reminded of their shameful past.

Now, though, thanks to the UCL research, we know that people all over the country profited from the slave trade. Many of them did not own land. Their slaves were managed by someone else and hired out to the plantations. The financialisation of the slave trade is a subject that has received very little attention but it enabled thousands of people who would never visit a plantation, let alone wield a whip or give an order, to invest in and profit from slavery. Small investors in the UK provided the expansion capital for the slave-owners and received handsome profits in return.

The financialisation of slavery reached its peak in the early 19th century. It enabled the rapid development of the Deep South’s cotton economy. The demand for cotton was increasing but the planters needed investment to get them going. In a detail that perhaps a lot of people missed, the plantation owners in 12 Years a Slave refer to mortgages on their slaves. They borrowed money, using their slaves as collateral, to finance their expansion.

Edward E. Baptist of Cornell University, author of The Half Has Never Been Told (HTSunny Singh) explains how this finance was raised:

"The cotton and slave trades were the biggest businesses in antebellum America, and then as now, American finance developed its most innovative products to finance the biggest businesses.

In the 1830s, powerful Southern slaveowners wanted to import capital into their states so they could buy more slaves. They came up with a new, two-part idea: mortgaging slaves; and then turning the mortgages into bonds that could be marketed all over the world."

Does something about that sound familiar? It should do.

"The financial product that such banks as Baring Brothers were selling to investors in London, Hamburg, Amsterdam, Paris, Philadelphia, Boston, and New York was remarkably similar to the securitised bonds, backed by mortgages on US homes, that attracted investors from around the globe to US financial markets from the 1980s until the economic collapse of 2008.

[M]ortgage-backed securities shifted risk away from the immediate originators of loans onto financial markets while promising to spread out and thus minimize the consequences of individual debtors’ failures. Investors who purchased latter-day mortgage-backed securities planned to share in streams of income generated by homebuyers’ mortgage payments.

Likewise, the faith bonds of the 1830s generated revenue for investors from enslavers’ repayments of mortgages on enslaved people. This meant that investors around the world would share in revenues made by hands in the field. Thus, in effect, even as Britain was liberating the slaves of its empire, a British bank could now sell an investor a completely commodified slave: not a particular individual who could die or run away, but a bond that was the right to a one-slave-sized slice of a pie made from the income of thousands of slaves."

The slave-backed securities of the early 19th century worked in the same way as the mortgage-backed securities of the early 21st. They spread the risks and provided a means by which capital from all over the world could be channelled into the Deep South. This also meant that, even after abolition, British investors could still profit from the slave trade. They no longer owned slaves. Instead, they owned slave-based derivatives; financial instruments made up of mortgages on enslaved people.

I couldn’t find any information on the extent of British investment in slave-backed securities but the involvement of Baring Brothers in the design and marketing of these products suggests that there must have been considerable demand in Britain. (This was also, incidentally, the trade that took Lehman Brothers from Alabama cotton broker to Wall Street finance house, giving the bank’s history a fascinating symmetry.) Even after emancipation, then, British investors were still profiting from the slave trade. As, too, were investors in other parts of Europe. Even countries like Germany, which had little direct involvement in slavery, provided finance through these bonds.

The financialisation of slavery led to its industrialisation. The cotton plantations were much bigger than those of the old Upper South. From 1831 to 1837 cotton production almost doubled. The demand for labour drove a massive transfer of slaves from the North and Upper South to the Deep South. Some historians calculate that twice as many people were sold south as were shipped to North America in the transatlantic trade. Even after abolition, through their slavery bonds, 19th century British investors financed as much misery as their ancestors did.

This was no cover up though. None of the information has been kept secret. Because of the financialisation of slavery, there are detailed records available on production, management and ownership. The UCL team and Edward Baptiste simply went looking where no-one else had. It is convenient to put a geographic boundary around slavery and restrict it to the masters and overseers in the the Deep South and the Caribbean, or the captains of slave ships from Bristol and Liverpool. But it could not have happened on the scale it did without investment from the northern US states and Europe. Evidence of this widespread involvement in the slave trade was there all along. We just chose not to look for it.