Scroll to the bottom to see the data.

Read more from Prospect's recent pensions supplement

In his Budget speech, George Osborne introduced substantial changes to the way Britain saves. The standout innovation was the introduction of the Lifetime ISA, a savings product that will come into force next year. Available to the under-40s, savers can deposit up to £4,000 a year, and the government will match payments, paying in £1 for every £4 saved. As Andy Davis points out on p4, this represents a substantial adjustment to the way in which saving is promoted by government.

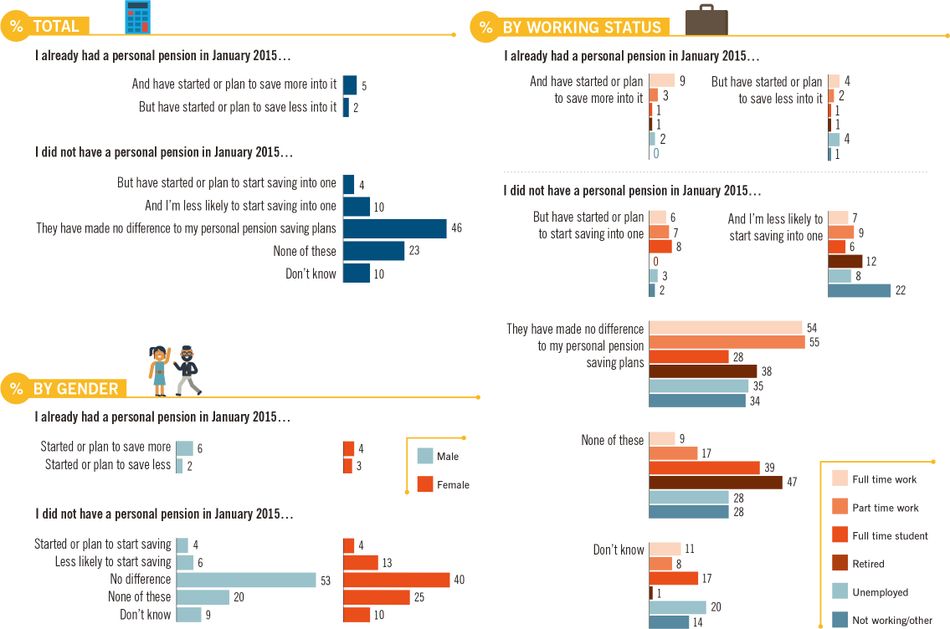

However, there is a pressing question about the extent to which the electorate is influenced by government changes to the savings and pension system. In the YouGov survey results below, the message is clear—it remains extremely hard for politicians to encourage saving. Since January 2015, the government has introduced substantial reforms to the annual allowance and lifetime allowance. It has also introduced the auto-enrolment scheme and the new pension freedoms, which removed the obligation for savers to use their pension savings to buy an annuity.

In the survey below, large numbers of respondents say that these changes have had no impact on how they save. This poses a deep challenge to the government, which has made the encouragement of saving one of its policy priorities. Britain’s population is ageing and the pensions system is under strain. Unless the government can make changes that people feel make a real difference, then savings will remain insufficient and the problem will only worsen.

Source: conducted by YouGov on behalf of Old Mutual Wealth