The UK government seeks a deal with the EU that makes trade as “frictionless as possible” either via a “new customs partnership” or through “highly-streamlined customs arrangements” involving simplified requirements and smart use of technology. While the aim of ensuring “business as usual” may be laudable, it is clear that Brexit will result in reduced market access for both the UK and the EU. What is unclear is what will be agreed, and therefore to what degree and over what time period. Nevertheless, neither a new customs partnership nor a highly streamlined customs arrangement is likely to come close to replicating existing levels of market access. Additionally, the EU has free trade agreements with 67 countries and Brexit means the UK will no longer be a party to these arrangements.

The lack of clarity complicates the ability to judge the effect of Brexit on different industries. This will depend firstly on what is agreed with the EU and existing FTA partners, and secondly on the structure of UK industries and how their businesses extend into EU and non- EU economies.

The UK’s high degree of market access into the EU derives from there being: no tariffs on UK trade with the EU, or with countries with which the EU has an agreement; no restrictions on the amount of foreign added value that can be included in goods traded with the EU; low non-tariff barriers arising from access to the single market for goods; and access to the single market for services.

Any impact will therefore depend on changes to these elements. Setting aside the non-negligible issue of transition, there are four possibilities: some form of customs union; a free trade area; a managed no-deal outcome, where Britain adopts “most favoured nation” terms; or crashing out of the EU with scant preparation. Each of the second two outcomes will result in tariffs between the UK and the EU. In the case of a customs union or FTA, the government has ruled out single market membership, so negotiations will also need to deal with non-tariff measures such as regulations.

For example, in addition to tariffs, trade in fresh vegetables depend on ports functioning properly, meat on standards inspections, pharmaceuticals on regulatory approvals, cars on standards conformity…

Source: Unless otherwise indicated all the statistics presented in this article are own calculations based on using the TradeSift software, using Comtrade data

The overall importance of the EU for UK trade is well documented—in 2016 the EU accounted for over 47 per cent of UK exports and 53 per cent of imports. These aggregate figures mask important sectoral differences.

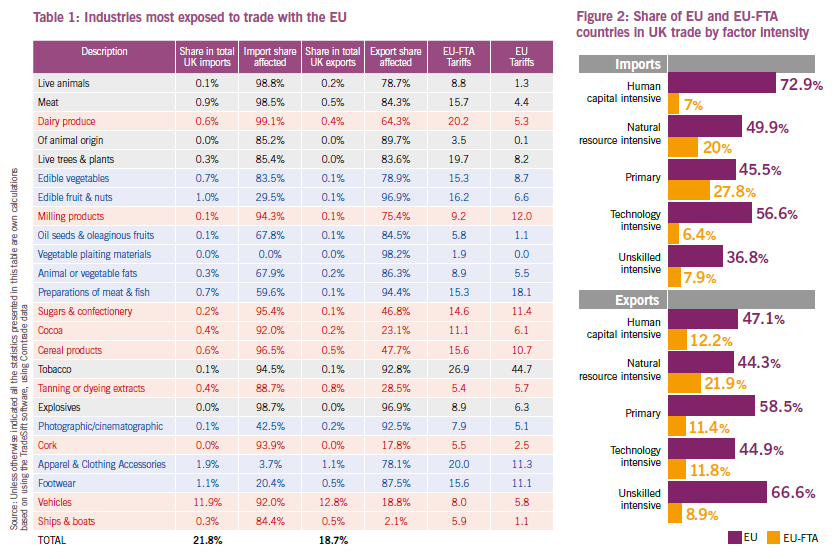

“The most exposed industries range from food products, textiles and clothing, to vehicles, ships and boats”We have calculated how important the EU is for the imports and exports of 5,200 different products. Figure 1, above, groups these products into percentage sharebands. The chart shows, for example, that for nearly 1,700 products more than 75 per cent of their exports go to the EU. Notably, this trading relationship goes both ways; for more than 1,700 products over 75 per cent of imports come from the EU. The products that fall within the over 75 per cent share-band account for nearly 30 per cent of the UK’s exports and 54 per cent of UK imports with the EU. Of these imports, over 1,300 products are subsequently used in other firms’ production processes either as intermediates or capital goods. A related point to consider is that the most exposed industries are very diverse and range from food products and textiles to vehicles and ships. Table 1 identifies the 15 most exposed industries for both imports and exports. The industries listed account for 16 per cent of total UK imports,

Tariff and non-tariff barriers: Table 1 also gives the tariffs which could arise in the event of a no-deal scenario. Both EU and EU-FTA tariffs could be substantial, so in addition to being highly dependent on the EU market, these industries are vulnerable with regard to tariffs. Taking all 5,200 products traded, there are nearly 600 where EU tariffs are greater than 10 per cent, accounting for 22 per cent of UK imports from the EU, 10 per cent from the EU-FTA countries, and 15 per cent of UK exports to the EU. There are over 1,600 products where the average tariff levied by EU-FTA partners is greater than 10 per cent, accounting for more than 20 per cent of UK exports to these countries.

This does not even take into account the impact of non-tariff barriers, nor of the implications for logistics and customs controls. Most evidence suggests that the “tariff equivalent” of such barriers may be considerably higher than the tariffs. Academic studies suggest that the tariff equivalents may be as high as 48 per cent in food processing, and around 20 per cent for chemicals, motor vehicles and electrical machinery. Though note that if, for example, a firm cannot show proof of conformity this would result in no exports, so the barrier could be even higher for some firms.

There has been much discussion of customs and logistics. Clearly smart technology can help—a bit—but this will not be for several years and in the meantime the UK’s physical and institutional infrastructure is seriously under-prepared. Equally there is much evidence that the level of preparation by many firms is highly inadequate.

In many industries, the UK is deeply integrated into EU supply chains made possible by single market access. Hence, more than 55 per cent of the UK’s EU exports, and more than 57 per cent of its EU imports, are either capital goods or intermediate goods. The link to EU supply chains, however, is not just between the UK and the EU. It depends also on being able to source intermediates from third countries. Within the automotive sector alone, over 38 per cent of UK imports from the FTA countries, and 50 per cent of imports from the rest of the world are intermediate goods or capital goods. Even a customs union will not give UK firms the same freedom to source inputs from non-EU countries and neither could the grandfathering of the existing free trade agreements.

Finally Brexit will impact on jobs and workers. The special nature of value chain integration with the EU can be seen by considering export jobs. There are around 3.7m UK jobs arising from exports to the EU. Nearly 40 per cent of these derive from supplying inputs to EU firms, which make products for further export. In contrast, out of the jobs arising from UK exports to the rest of the world, only 16 per cent are associated with further onward exports.

We can also classify industries according to how intensively they used different inputs (capital, skilled labour, primary products…) in production (Table 2). The data suggests that for human-capital (skilled-labour) intensive industries and unskilled labour intensive industries the EU and the EU FTA countries account for more than 60 per cent and 75 per cent of UK exports respectively, and for 80 per cent and nearly 45 per cent of UK imports respectively.

This overview identifies what factors will be important in assessing the impact on UK industries, and some pointers for how a detailed analysis could be undertaken. Doing this shows that the impacts are likely to be both substantial and highly differential across industries, and that neither a customs union nor a free trade area could achieve “frictionless” trade.

Brexit Britain: the future of industry is a publication which examines the future of UK manufacturing through the prism of the recently released Industrial Strategy White Paper. The report features contributions from the likes of Greg Clark MP, Miriam Gonzalez, Richard Graham MP and Frances O’Grady.

To find out more about how you can become involved in Prospect’s thought leadership programmes, please contact saskia.abdoh@prospect-magazine.co.uk.

If you want to know all about where industry is headed in Brexit Britain, you can download the whole Brexit Britain: The future of industry reportas a fully designed PDF document. To do so, simply enter your email below. You’ll receive your copy completely free—within minutes. [prosform fields="email,forename,surname" signupcode="Industry" countrycode="GB" redirect="other/the-future-of-industry-is-yours"]

When you sign up for this free report, you will also join our free Prospect newsletter.

Prospect takes your privacy seriously. We promise never to rent or sell your e-mail address to any third party. You can unsubscribe from the Prospect newsletter at any time.