Peer-to-Peer (P2P) lending is one of the few genuinely new opportunities for retail investors to emerge in recent years and has attracted growing numbers of people seeking new ways to generate income from their capital. Based on websites that bring together investors with cash to deploy and borrowers seeking debt funding, P2P is usually divided into two camps: sites that arrange loans for private individuals and those that cater for businesses, although in practice the lines are becoming blurred nowadays as some consumer sites extend their offer to small companies and sole traders.

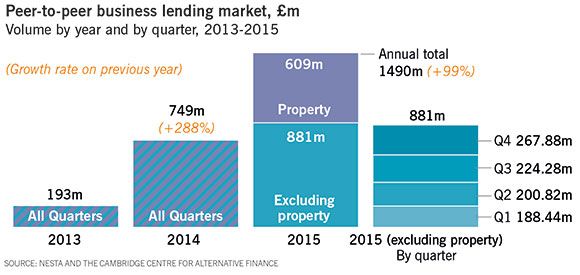

Since the first business-focused P2P sites—sometimes labelled P2B—such as Funding Circle and ThinCats launched in 2010 and 2011, interest rates on mainstream savings accounts have crashed, making the returns available from direct lending to small companies—typically starting around 6 per cent and rising well into double figures—look very attractive by comparison. As a result, money has flowed in from both individuals and institutions: lending to small companies now makes up more than half of all P2P activity in the UK, accounting for around £3.8bn of the £6.6bn advanced to date, according to Altfi Data. Minimum investments can be as low as £20 per loan and as high as £1,000 or more.

More recently, P2B sites have expanded into new areas, particularly various types of property lending including short-term bridging loans for borrowers looking to purchase property for development, funding for the development work itself and longer-term commercial mortgages. The great attraction of P2B lending, therefore, is its diversity. Individual P2B sites often specialise in a particular type of lending but by spreading money across several of them a DIY investor can cover the waterfront and assemble a portfolio ranging from secured and unsecured lending to small companies, short-term loans to property buyers and developers, longer-term commercial mortgages and even very short-term invoice finance (although this is usually restricted to high net worth investors).

Terms can range from 30-90 days for invoice finance right up to five years for conventional loans, though investors should be aware that P2B sites usually offer borrowers very flexible terms including the option to repay early without penalties. You may therefore find that a loan you thought would be producing income for the next few years is paid off unexpectedly, forcing you to seek a new lending opportunity to keep your cash working.

Although P2B sites all tend to operate in slightly different ways the basic approach remains the same: loan opportunities are advertised on the site and groups of investors club together to make up the sum required. Most sites nowadays offer loans at fixed interest rates and some place loans into bands according to their expected level of risk. A few still run so-called dynamic auctions, whereby investors bid against each other to lend, with the lowest offers winning. Some also give investors the choice of picking the borrowers they want to lend to for themselves or using an automated bidding system that will split their capital up into small portions and spread it across a set number of loans that meet specified criteria. These automated systems will continue to re-lend money as it is repaid, ensuring that investors do not see their returns diluted unduly by un-invested cash.

Although critics of the P2P sector, which is regulated by the Financial Conduct Authority, have claimed it carries greater risk that most investors realise, the evidence to date suggests that defaults and losses are comfortably in line with typical levels for small business borrowers—suggesting that P2B sites are not simply picking up business that others deem too risky—and that most retail investors who have tried P2B lending are happy with the results they have achieved. Of course, this doesn’t mean P2B lending is low-risk. Although P2B sites do not lend to start-ups and very young companies, even well-established businesses with experienced managers can hit trouble for all sorts of reasons and therefore investors need to build in realistic assumptions about likely losses (as well as factoring in tax, where necessary) when deciding how high a return they require to compensate them for the risks they are taking.

But with a few sensible precautions, an attractive way to generate returns and diversify your other investments is now available.