Click here to read more from our November 2016 issue

In the 1990s, globalisation was often characterised as inevitable and irreversible. Politicians like Bill Clinton and Tony Blair saw it as the unstoppable wave of the future and sought to ride it for all it was worth. Today that sense of inevitability has been cast into doubt, and the question being asked is whether our own era of globalisation could soon be undone, just as a remarkable earlier era of economic integration across political borders at the turn of the 20th century—which also affected trade, migration and investment—came unstuck during the era of the two world wars.

In the United States presidential campaign, Donald Trump’s pledge to resist new trade deals and renounce existing ones has forced Hillary Clinton, as a rear-guard electoral action, to reverse her previous support for the Trans-Pacific Partnership trade agreement. The victory of “Leave” in the British referendum on European Union membership is likewise held up as foretelling the end of 21st-century globalisation. “Brexit,” the former World Bank economist Homi Kharas lamented in Newsweek, “represents the first tangible retreat from globalisation in my lifetime.”

In this view, Brexit is a manifestation of a mounting backlash against ever-deeper international entanglements in general, not just entanglements with the EU. It reflects the sense that, with all the dismantling of national economic controls, and the ceding of power over trade and the like to global bodies such as the World Trade Organisation (WTO) the nation state has fundamentally lost control of its destiny, surrendering to anonymous global forces. And what is true of Britain is true of other countries such as France, Germany and Sweden, where the ultra-right Front National, the anti-euro Alternative für Deutschland (Alternative for Germany, or AfD) and the anti-immigrant Sweden Democrats are all capitalising on the same populist, nationalist, and anti-globalisation sentiment. Their growing support is cited as evidence that globalisation is poised to shift into reverse.

One reason for taking these predictions with a pinch of salt is that we have heard them before. In 2002, the economic historian Harold James published The End of Globalization, in which he pointed to the collapse of international trade and payments in the 1930s and warned that the same could happen again. In 2005, Niall Ferguson argued in Foreign Affairs that conflicts like those in Iraq and Afghanistan and the tensions between China and the US in the South China Sea could sink globalisation, just as the geopolitical conflicts culminating in the First World War had caused German U-Boats to sink millions of tons of ocean shipping in a violent end to the pre-1914 era of globalisation.

The aftermath of the financial crisis has undoubtedly emboldened populist forces—as well as pundits who wish to argue that we are recreating the 1930s. But historical analogies are a dime a dozen. In fact, there has been no second Great Depression. The 2008-9 financial crisis was, for sure, a shock to the world economy, but the dislocations and fall in output were, even in the worst hit of the big economies, mild in comparison with the cataclysmic crisis of the 1930s that led to the collapse of international trade and finance. Thus far, 21st-century globalisation has not palpably unravelled.

Although there are certainly disputes between China, Russia and the west, neither have these risen to the heights of the 1930s. The US has slapped anti-dumping duties on Chinese steel exports, and western sanctions have curtailed foreign investment in Russia. But geopolitical tensions have not led to across-the-board import tariffs or to the imposition of harsh controls on international capital flows like those applied by Hjalmar Schacht, Adolf Hitler’s finance minister, in the 1930s—the sort of measures that really did set globalisation spinning into reverse during the interwar years.

1—Trading definitions

One reason to be suspicious of claims that globalisation is again going into reverse today is the lack of agreement on what is meant by “globalisation” itself. For some, it is a process of furthering the development of an increasingly integrated world economy marked by free trade, the free flow of capital and free international movement of labour. The operative word in this formulation is “increasingly.” Here I am consciously echoing the preamble to the 1957 Treaty of Rome, the founding document of the EU, where integration is described as “ever closer union.” Globalisation, so defined, is a process, not a state. It is a dynamic that must continue or else collapse.

This is the “bicycle theory” of integration, a phrase coined by Walter Hallstein and used to describe the way in which relations between European nations must always be moving forward and growing deeper so as to avoid losing momentum. The “ever closer” ideal began with the actions of Jean Monnet and Robert Schuman who pushed for the creation of the European Coal and Steel Community. Globalisation must either continue moving forward, in this view, or else risk falling back.

For others, globalisation instead means a world in which national markets are integrated to some substantial degree—but not necessarily becoming continually more closely bound. A globalised world here is one in which certain types of merchandise are traded across borders, but other goods and services—think healthcare services for instance—are still provided mainly at the national level. It is a world where some forms of cross-border investment are freely permitted but others, financial transfers in and out of China for example, remain limited. It is one where the movement of labour across borders is subject to more restrictions than movements of merchandise and finance. It is the world in which we live today, in other words.

Globalisation in the 21st century, so seen, is a state, not a process. It is a state that can be adjusted, in the direction of less integration as well as more, as the public and its elected leaders see fit, without threatening interdependence in all its aspects.

The first view, that globalisation consists of ever-deeper integration, is the most promising interpretation for those who wish to read the last rites. It is an interpretation grounded in the particular experience of the last quarter century before the crisis.

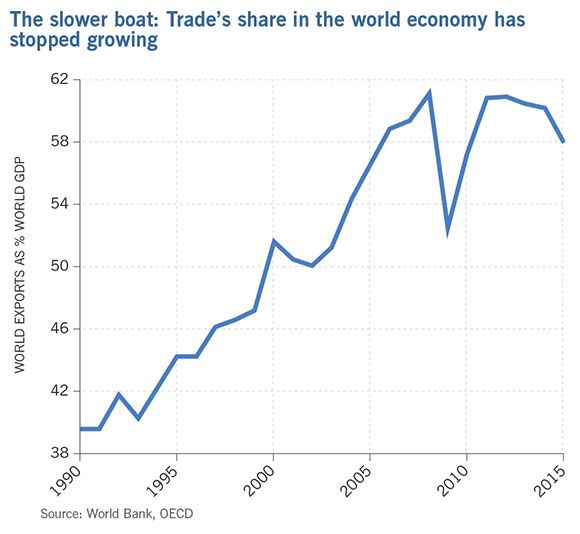

The volume of global trade increased continuously from the late 1980s through the global financial crisis at an annual average rate of 8 per cent, nearly twice as fast as the production of goods and services, as measured by global real GDP. Cross-border financial flows grew more rapidly still—where the foreign financial assets and liabilities of countries were a little more than a quarter of global GDP at the end of the 1990s, they are now well more than 100 per cent, reflecting the breakneck pace of financial globalisation. The number of international migrants, defined as persons living in a country other than where they were born, reached 244m in 2015—some 41 per cent higher than in 2000. World population, in contrast, rose more slowly, by around 12 per cent over the period.

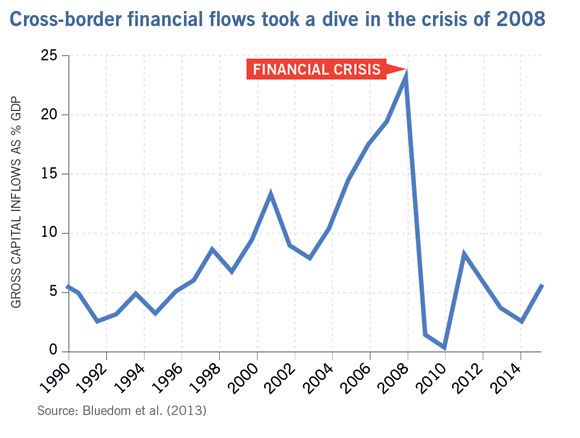

Globalisation, these observations all suggest, has been a process of progressively deeper integration. It has deepened in the past and so the suggested conclusion is that it will continue deepening in the future—assuming, of course, that it does not collapse. Since 2010, on this interpretation, globalisation has indeed shown signs of spinning into reverse. Global trade has grown more slowly than before, by just 2 per cent per annum. Global GDP, it is worth recalling, continued to expand despite all the world’s travail, at an annual average rate of nearly 4 per cent, and so the trade-to-GDP ratio, probably the most straightforward measure of globalisation, has thus been falling, not rising. More strikingly still, gross financial flows across borders are now down to half their pre-2009 levels, a development that has become known as “The Great Retrenchment.” And, contrary to widespread presumption, the global stock of international migrants actually rose less rapidly in 2010-15, by 10 per cent, than in 2005-10, when it climbed by 16 per cent.

There is, however, strong reason to favour a second view, that globalisation is a state in which societies and governments accept a degree of integration and the ceding of certain sovereign national prerogatives, but no more. This state can persist without requiring “ever deeper integration.” Indeed the experience of the last few years suggests that there is no reason why the volume of cross-border transactions can’t grow more slowly, or even decline absolutely for a time, while also allowing societies to maintain their basic commitment to openness and interdependence. Although global trade has plateaued, there has been no global trade war. While cross-border financial transactions have fallen, they have not collapsed. There has been no Schachtian constriction of international capital flows like that of the 1930s.

So much, then, for the bicycle theory. The rate of growth of cross-border transactions can evidently be stabilised or modulated—globalisation can be recalibrated, in other words—without placing the phenomenon itself at risk. Brexit, if this is correct, does not spell the end of globalisation, either for Britain or generally. It simply signals a new era in which the UK government, and perhaps others, put the brakes on ever-deeper integration in an effort to better regulate and manage those aspects that they see as problematic.

2—The shipping news

The validity of this soothing conclusion depends on exactly why the growth of cross-border trade, financial and migratory flows have slowed and, in some cases, gone into reverse. And there is, once again, little agreement about this. There has been debate in the corridors of the World Bank and the secretariat of the WTO over whether the decline in trade relative to GDP is a cyclical or secular phenomenon, and thus whether it is temporary or permanent. But the longer that decline persists, and it has now persisted for the better part of a decade, the harder it becomes to maintain that we are simply seeing a cyclical downturn that will reverse once the global economy recovers.

The Baltic Dry Index, which measures the cost of chartering the large ships that carry most long-distance trade, has recovered from its February all-time low but still lags well behind where it stood a couple of years ago. It is a forward-looking indicator—ships are chartered now to deliver goods in the future—which suggests that markets do not expect vigorous trade growth to resume soon. That may be because of the end of the two processes that drove the exceptionally rapid growth of cross-border transactions in the quarter-century before the crisis.

One is the hyper-growth of China. Over this period, China rose from far down the league tables to become the second largest economy in the world, and the single largest trader, as measured by the value of its exports. Its export sales grew by a breathtaking 20 per cent plus annually. Its demand for imported energy and raw materials in turn produced an export boom for energy and commodity producers like Russia and Brazil, thereby contributing further to the rapid expansion of global trade.

But Chinese GDP growth has slowed from more than 10 per cent per annum to less than 7 per cent. Beijing, furthermore, is attempting to rebalance the economy away from exports and towards domestic demand, in part to avoid fanning tensions with rival exporters like the US. The result in 2015 was an unprecedented fall in the volume of Chinese trade, of some 8 per cent. This goes a long way toward explaining the slowdown in world trade, given that China accounts for nearly 15 per cent of global exports. With China’s exports growing more slowly, its imports will also grow more slowly, implying lower export sales for commodity and energy producers that depend on the Chinese market.

Importantly, this new situation is permanent. The slowdown in Chinese growth will not be reversed. The country’s labour force is now shrinking, a legacy of the one-child policy. And when it comes to technical progress, China can no longer power ahead simply by acquiring technology from abroad. Its advanced sectors must instead grapple with the tougher challenge of developing entirely new technologies. In the future, as Beijing well understands, China’s growth will resemble that of other relatively mature middle-income countries. That is to say, it will be slower. Chinese policy makers recognise this. Nor do they have illusions about returning to export-led growth. The days when China’s exports could grow two or three times as fast as the economy are gone for good.

The other distinctive factor stimulating trade over the last quarter of a century was the development of global supply chains. Once upon a time, a laptop computer was produced in one country and exported to another. Now the plastic and aluminium are produced in one set of countries, combined into components in a second, assembled into the final product in a third, and then shipped to markets in the fourth. This unbundling of production and distribution has allowed firms to reduce their costs, raise their profits, and expand their markets. It also registers mechanically as an increase in global trade, since the same items cross national borders not once but several times, first as imported components and then as exported final products. But it also represents a fundamental increase in globalisation, in that the production process is spread across multiple countries.

Managing such a fragmented production process isn’t easy, however. At some point, unbundling that process still further and coordinating more stages in yet more countries encounters diminishing returns. The risk of port strikes and natural disasters like Japan’s 2011 tsunami, which disrupted the supply chains of automotive producers worldwide, becomes too great. Advances like 3D printing, known in the business as “additive manufacturing,” make it more economical to produce components near the final point of assembly and sale. All this gives reason to think that the explosive growth of global supply chains is now over. Again, it seems that the slower growth—and even stagnation—of trade is not a passing phenomenon. But it is something that can come about organically for very particular reasons, without any great political disruption, or any new tendency for societies to seek to shut themselves off from the world.

3—Cold money

The slowdown in international capital flows since 2009 has been even more dramatic than the slowdown in the growth of trade. Most of the drop has come in the form of reduced cross-border bank lending and borrowing. It follows that countries most dependent on banks have been hit hardest by the “Great Retrenchment.” In practice this means Europe, where banks, as opposed to securities markets, play a larger role than in the US. A decline is also evident in some emerging markets—especially in those with less developed stock and bond markets, that rely disproportionately on international banks.

Some argue that cross-border bank lending has declined because the crisis reminded the bankers that cross-border business is risky. European banks burned by purchases of US subprime-mortgage-linked securities and Greek government bonds learned the hard way about the advantages of focussing on familiar borrowers at home. Perhaps. But the main driver of the decline in cross-border bank lending has been the tighter bank regulation that followed the crunch of 2007-08.

Banks were at the heart of the crisis. Their missteps created problems for the public and the entire financial system. Post-crisis changes in regulation focussed on them. Banks are now required to raise more capital and hold more high-quality liquid assets. All of this makes bank lending costlier. And cross-border bank lending, the regulators concluded, is especially risky. A recent International Monetary Fund study found that the regulation that has been tightened up most has been that directed at banks’ international operations. Not surprisingly, many banks responded by curtailing their overseas involvement. That same IMF study concludes that regulatory tightening can explain half the decline in cross-border bank lending between 2007 and 2013.

And as is the case with the slower growth of trade, this decline in cross-border bank lending is unlikely to be temporary, assuming that governments do not forget all about the crisis, and revert to light-touch regulation. But neither do these changes mark the end of financial globalisation. Foreign direct investment—financial flows to build foreign factories and acquire foreign companies—continues at pre-crisis levels. So too do cross-border borrowing and lending in stock and bond markets.

In sum, regulators have engineered a partial de-globalisation of finance, having concluded that the portion in the hands of banks was unsafe. But the other strands weaving national capital markets into a global web, direct foreign investment and cross-border securities transactions, continue as before.

4—Hitting a wall

Finally, in contrast to widespread belief, the international migrant flow is also now growing more slowly. This slowdown was evident even in a European continent which confronts a refugee crisis, where the number of immigrants grew by 13 per cent in 2005-10 but by a slower 5 per cent in 2010-15. It is evident in the US too. Despite Trump’s fixation on Mexican immigration, according to data from the Pew Research Center more Mexicans are now leaving the US than entering it.

The slower growth of migration reflects developments in both the sending and receiving countries: tighter admission policies in many rich countries, and better economic performance, relatively speaking, in some countries of origin, as in the Mexican case. Further restrictions are now likely to be imposed by high-income countries where voters believe, rightly or wrongly, that immigrants apply pressure on public services or pose a security threat.

Anti-immigrant sentiment played a significant role in the victory of the “Leave” campaign in the Brexit referendum, and Theresa May’s Conservative government has evidently heard the message. The desire to restrict immigration is similarly a powerful force animating the Republican Party in the US presidential campaign. The French government has demanded changes to EU rules allowing companies to hire cheap workers in Eastern Europe and then to “post” them in high-income countries without having to follow host-country industry wage agreements—a demand that has been met by the EU.

But these measures are not the same as comprehensive bans bringing all immigration to a halt. The US will continue to admit engineers recruited by Silicon Valley companies and to reunite families through its Green Card Program whether President Trump—should he be elected in November—builds a wall or not. EU members will continue to respect the free mobility of labour as one of the four fundamental freedoms of their Single Market. That certainty, after all, was the very thing that galvanised support for the UK “Leave” campaign. Social and political pressures, then, may somewhat slow the migratory flows. But the incentive for immigration, from low-income and politically unstable regions in particular, will not vanish. Neither will the immigration itself.

5—Recalibration, not retreat

So does Brexit spell the end of globalisation? As we have seen, a significant shift in the trajectory of international integration was underway even before the referendum.

The phase where global merchandise trade grew faster than global output had already come to an end, because of the passing of supercharged Chinese growth, and of a distinctive phase of rapid development in global supply chains. The hyper-globalisation of financial markets, which created as many problems as it solved, slowed as regulators clamped down on risky cross-border bank lending. And, contrary to widespread belief, the rate of growth of the global immigrant population had already slowed, reflecting tighter border controls in some countries and better growth prospects in others.

So if by globalisation we mean an era when flows of merchandise, capital and labour across borders grow several times faster than GDP, then we can say that this phase in global affairs is already over. But if we mean a state where national economies are linked together by those flows—subject to adjustments as different countries see fit—then globalisation remains firmly in place.

The UK government will now seek to negotiate and implement new restrictions on the movement of workers into the country, the mandate it takes from the referendum. But it remains committed to free trade. New International Trade Secretary Liam Fox has been globe-trotting and bullishly talking about a post-Brexit Britain as trading even more freely than before—indeed he even predicts it could achieve “even freer” trade with Europe from outside the EU. The government is committed, too, to preserving the City’s position as an international financial centre, which will mean maintaining and even enhancing the freedom of residents and foreigners to move money in and out of the country. Whether it will achieve these goals, which will require agreements with foreign governments, only time will tell. There are reasons to be sceptical. But if it succeeds, Brexit will be seen as a recalibration rather than a retreat from globalisation—which in a sense is the same transition the rest of the world is also going through.

Barry Eichengreen will be a panellist at the Prospect debate: Brexit: Whither Globalisation? taking place on Wednesday 2nd November at 6:30pm.

In the 1990s, globalisation was often characterised as inevitable and irreversible. Politicians like Bill Clinton and Tony Blair saw it as the unstoppable wave of the future and sought to ride it for all it was worth. Today that sense of inevitability has been cast into doubt, and the question being asked is whether our own era of globalisation could soon be undone, just as a remarkable earlier era of economic integration across political borders at the turn of the 20th century—which also affected trade, migration and investment—came unstuck during the era of the two world wars.

In the United States presidential campaign, Donald Trump’s pledge to resist new trade deals and renounce existing ones has forced Hillary Clinton, as a rear-guard electoral action, to reverse her previous support for the Trans-Pacific Partnership trade agreement. The victory of “Leave” in the British referendum on European Union membership is likewise held up as foretelling the end of 21st-century globalisation. “Brexit,” the former World Bank economist Homi Kharas lamented in Newsweek, “represents the first tangible retreat from globalisation in my lifetime.”

In this view, Brexit is a manifestation of a mounting backlash against ever-deeper international entanglements in general, not just entanglements with the EU. It reflects the sense that, with all the dismantling of national economic controls, and the ceding of power over trade and the like to global bodies such as the World Trade Organisation (WTO) the nation state has fundamentally lost control of its destiny, surrendering to anonymous global forces. And what is true of Britain is true of other countries such as France, Germany and Sweden, where the ultra-right Front National, the anti-euro Alternative für Deutschland (Alternative for Germany, or AfD) and the anti-immigrant Sweden Democrats are all capitalising on the same populist, nationalist, and anti-globalisation sentiment. Their growing support is cited as evidence that globalisation is poised to shift into reverse.

One reason for taking these predictions with a pinch of salt is that we have heard them before. In 2002, the economic historian Harold James published The End of Globalization, in which he pointed to the collapse of international trade and payments in the 1930s and warned that the same could happen again. In 2005, Niall Ferguson argued in Foreign Affairs that conflicts like those in Iraq and Afghanistan and the tensions between China and the US in the South China Sea could sink globalisation, just as the geopolitical conflicts culminating in the First World War had caused German U-Boats to sink millions of tons of ocean shipping in a violent end to the pre-1914 era of globalisation.

The aftermath of the financial crisis has undoubtedly emboldened populist forces—as well as pundits who wish to argue that we are recreating the 1930s. But historical analogies are a dime a dozen. In fact, there has been no second Great Depression. The 2008-9 financial crisis was, for sure, a shock to the world economy, but the dislocations and fall in output were, even in the worst hit of the big economies, mild in comparison with the cataclysmic crisis of the 1930s that led to the collapse of international trade and finance. Thus far, 21st-century globalisation has not palpably unravelled.

Although there are certainly disputes between China, Russia and the west, neither have these risen to the heights of the 1930s. The US has slapped anti-dumping duties on Chinese steel exports, and western sanctions have curtailed foreign investment in Russia. But geopolitical tensions have not led to across-the-board import tariffs or to the imposition of harsh controls on international capital flows like those applied by Hjalmar Schacht, Adolf Hitler’s finance minister, in the 1930s—the sort of measures that really did set globalisation spinning into reverse during the interwar years.

1—Trading definitions

One reason to be suspicious of claims that globalisation is again going into reverse today is the lack of agreement on what is meant by “globalisation” itself. For some, it is a process of furthering the development of an increasingly integrated world economy marked by free trade, the free flow of capital and free international movement of labour. The operative word in this formulation is “increasingly.” Here I am consciously echoing the preamble to the 1957 Treaty of Rome, the founding document of the EU, where integration is described as “ever closer union.” Globalisation, so defined, is a process, not a state. It is a dynamic that must continue or else collapse.

This is the “bicycle theory” of integration, a phrase coined by Walter Hallstein and used to describe the way in which relations between European nations must always be moving forward and growing deeper so as to avoid losing momentum. The “ever closer” ideal began with the actions of Jean Monnet and Robert Schuman who pushed for the creation of the European Coal and Steel Community. Globalisation must either continue moving forward, in this view, or else risk falling back.

For others, globalisation instead means a world in which national markets are integrated to some substantial degree—but not necessarily becoming continually more closely bound. A globalised world here is one in which certain types of merchandise are traded across borders, but other goods and services—think healthcare services for instance—are still provided mainly at the national level. It is a world where some forms of cross-border investment are freely permitted but others, financial transfers in and out of China for example, remain limited. It is one where the movement of labour across borders is subject to more restrictions than movements of merchandise and finance. It is the world in which we live today, in other words.

Globalisation in the 21st century, so seen, is a state, not a process. It is a state that can be adjusted, in the direction of less integration as well as more, as the public and its elected leaders see fit, without threatening interdependence in all its aspects.

The first view, that globalisation consists of ever-deeper integration, is the most promising interpretation for those who wish to read the last rites. It is an interpretation grounded in the particular experience of the last quarter century before the crisis.

The volume of global trade increased continuously from the late 1980s through the global financial crisis at an annual average rate of 8 per cent, nearly twice as fast as the production of goods and services, as measured by global real GDP. Cross-border financial flows grew more rapidly still—where the foreign financial assets and liabilities of countries were a little more than a quarter of global GDP at the end of the 1990s, they are now well more than 100 per cent, reflecting the breakneck pace of financial globalisation. The number of international migrants, defined as persons living in a country other than where they were born, reached 244m in 2015—some 41 per cent higher than in 2000. World population, in contrast, rose more slowly, by around 12 per cent over the period.

Globalisation, these observations all suggest, has been a process of progressively deeper integration. It has deepened in the past and so the suggested conclusion is that it will continue deepening in the future—assuming, of course, that it does not collapse. Since 2010, on this interpretation, globalisation has indeed shown signs of spinning into reverse. Global trade has grown more slowly than before, by just 2 per cent per annum. Global GDP, it is worth recalling, continued to expand despite all the world’s travail, at an annual average rate of nearly 4 per cent, and so the trade-to-GDP ratio, probably the most straightforward measure of globalisation, has thus been falling, not rising. More strikingly still, gross financial flows across borders are now down to half their pre-2009 levels, a development that has become known as “The Great Retrenchment.” And, contrary to widespread presumption, the global stock of international migrants actually rose less rapidly in 2010-15, by 10 per cent, than in 2005-10, when it climbed by 16 per cent.

There is, however, strong reason to favour a second view, that globalisation is a state in which societies and governments accept a degree of integration and the ceding of certain sovereign national prerogatives, but no more. This state can persist without requiring “ever deeper integration.” Indeed the experience of the last few years suggests that there is no reason why the volume of cross-border transactions can’t grow more slowly, or even decline absolutely for a time, while also allowing societies to maintain their basic commitment to openness and interdependence. Although global trade has plateaued, there has been no global trade war. While cross-border financial transactions have fallen, they have not collapsed. There has been no Schachtian constriction of international capital flows like that of the 1930s.

So much, then, for the bicycle theory. The rate of growth of cross-border transactions can evidently be stabilised or modulated—globalisation can be recalibrated, in other words—without placing the phenomenon itself at risk. Brexit, if this is correct, does not spell the end of globalisation, either for Britain or generally. It simply signals a new era in which the UK government, and perhaps others, put the brakes on ever-deeper integration in an effort to better regulate and manage those aspects that they see as problematic.

2—The shipping news

The validity of this soothing conclusion depends on exactly why the growth of cross-border trade, financial and migratory flows have slowed and, in some cases, gone into reverse. And there is, once again, little agreement about this. There has been debate in the corridors of the World Bank and the secretariat of the WTO over whether the decline in trade relative to GDP is a cyclical or secular phenomenon, and thus whether it is temporary or permanent. But the longer that decline persists, and it has now persisted for the better part of a decade, the harder it becomes to maintain that we are simply seeing a cyclical downturn that will reverse once the global economy recovers.

The Baltic Dry Index, which measures the cost of chartering the large ships that carry most long-distance trade, has recovered from its February all-time low but still lags well behind where it stood a couple of years ago. It is a forward-looking indicator—ships are chartered now to deliver goods in the future—which suggests that markets do not expect vigorous trade growth to resume soon. That may be because of the end of the two processes that drove the exceptionally rapid growth of cross-border transactions in the quarter-century before the crisis.

One is the hyper-growth of China. Over this period, China rose from far down the league tables to become the second largest economy in the world, and the single largest trader, as measured by the value of its exports. Its export sales grew by a breathtaking 20 per cent plus annually. Its demand for imported energy and raw materials in turn produced an export boom for energy and commodity producers like Russia and Brazil, thereby contributing further to the rapid expansion of global trade.

But Chinese GDP growth has slowed from more than 10 per cent per annum to less than 7 per cent. Beijing, furthermore, is attempting to rebalance the economy away from exports and towards domestic demand, in part to avoid fanning tensions with rival exporters like the US. The result in 2015 was an unprecedented fall in the volume of Chinese trade, of some 8 per cent. This goes a long way toward explaining the slowdown in world trade, given that China accounts for nearly 15 per cent of global exports. With China’s exports growing more slowly, its imports will also grow more slowly, implying lower export sales for commodity and energy producers that depend on the Chinese market.

Importantly, this new situation is permanent. The slowdown in Chinese growth will not be reversed. The country’s labour force is now shrinking, a legacy of the one-child policy. And when it comes to technical progress, China can no longer power ahead simply by acquiring technology from abroad. Its advanced sectors must instead grapple with the tougher challenge of developing entirely new technologies. In the future, as Beijing well understands, China’s growth will resemble that of other relatively mature middle-income countries. That is to say, it will be slower. Chinese policy makers recognise this. Nor do they have illusions about returning to export-led growth. The days when China’s exports could grow two or three times as fast as the economy are gone for good.

The other distinctive factor stimulating trade over the last quarter of a century was the development of global supply chains. Once upon a time, a laptop computer was produced in one country and exported to another. Now the plastic and aluminium are produced in one set of countries, combined into components in a second, assembled into the final product in a third, and then shipped to markets in the fourth. This unbundling of production and distribution has allowed firms to reduce their costs, raise their profits, and expand their markets. It also registers mechanically as an increase in global trade, since the same items cross national borders not once but several times, first as imported components and then as exported final products. But it also represents a fundamental increase in globalisation, in that the production process is spread across multiple countries.

Managing such a fragmented production process isn’t easy, however. At some point, unbundling that process still further and coordinating more stages in yet more countries encounters diminishing returns. The risk of port strikes and natural disasters like Japan’s 2011 tsunami, which disrupted the supply chains of automotive producers worldwide, becomes too great. Advances like 3D printing, known in the business as “additive manufacturing,” make it more economical to produce components near the final point of assembly and sale. All this gives reason to think that the explosive growth of global supply chains is now over. Again, it seems that the slower growth—and even stagnation—of trade is not a passing phenomenon. But it is something that can come about organically for very particular reasons, without any great political disruption, or any new tendency for societies to seek to shut themselves off from the world.

3—Cold money

The slowdown in international capital flows since 2009 has been even more dramatic than the slowdown in the growth of trade. Most of the drop has come in the form of reduced cross-border bank lending and borrowing. It follows that countries most dependent on banks have been hit hardest by the “Great Retrenchment.” In practice this means Europe, where banks, as opposed to securities markets, play a larger role than in the US. A decline is also evident in some emerging markets—especially in those with less developed stock and bond markets, that rely disproportionately on international banks.

Some argue that cross-border bank lending has declined because the crisis reminded the bankers that cross-border business is risky. European banks burned by purchases of US subprime-mortgage-linked securities and Greek government bonds learned the hard way about the advantages of focussing on familiar borrowers at home. Perhaps. But the main driver of the decline in cross-border bank lending has been the tighter bank regulation that followed the crunch of 2007-08.

Banks were at the heart of the crisis. Their missteps created problems for the public and the entire financial system. Post-crisis changes in regulation focussed on them. Banks are now required to raise more capital and hold more high-quality liquid assets. All of this makes bank lending costlier. And cross-border bank lending, the regulators concluded, is especially risky. A recent International Monetary Fund study found that the regulation that has been tightened up most has been that directed at banks’ international operations. Not surprisingly, many banks responded by curtailing their overseas involvement. That same IMF study concludes that regulatory tightening can explain half the decline in cross-border bank lending between 2007 and 2013.

And as is the case with the slower growth of trade, this decline in cross-border bank lending is unlikely to be temporary, assuming that governments do not forget all about the crisis, and revert to light-touch regulation. But neither do these changes mark the end of financial globalisation. Foreign direct investment—financial flows to build foreign factories and acquire foreign companies—continues at pre-crisis levels. So too do cross-border borrowing and lending in stock and bond markets.

In sum, regulators have engineered a partial de-globalisation of finance, having concluded that the portion in the hands of banks was unsafe. But the other strands weaving national capital markets into a global web, direct foreign investment and cross-border securities transactions, continue as before.

4—Hitting a wall

Finally, in contrast to widespread belief, the international migrant flow is also now growing more slowly. This slowdown was evident even in a European continent which confronts a refugee crisis, where the number of immigrants grew by 13 per cent in 2005-10 but by a slower 5 per cent in 2010-15. It is evident in the US too. Despite Trump’s fixation on Mexican immigration, according to data from the Pew Research Center more Mexicans are now leaving the US than entering it.

The slower growth of migration reflects developments in both the sending and receiving countries: tighter admission policies in many rich countries, and better economic performance, relatively speaking, in some countries of origin, as in the Mexican case. Further restrictions are now likely to be imposed by high-income countries where voters believe, rightly or wrongly, that immigrants apply pressure on public services or pose a security threat.

Anti-immigrant sentiment played a significant role in the victory of the “Leave” campaign in the Brexit referendum, and Theresa May’s Conservative government has evidently heard the message. The desire to restrict immigration is similarly a powerful force animating the Republican Party in the US presidential campaign. The French government has demanded changes to EU rules allowing companies to hire cheap workers in Eastern Europe and then to “post” them in high-income countries without having to follow host-country industry wage agreements—a demand that has been met by the EU.

But these measures are not the same as comprehensive bans bringing all immigration to a halt. The US will continue to admit engineers recruited by Silicon Valley companies and to reunite families through its Green Card Program whether President Trump—should he be elected in November—builds a wall or not. EU members will continue to respect the free mobility of labour as one of the four fundamental freedoms of their Single Market. That certainty, after all, was the very thing that galvanised support for the UK “Leave” campaign. Social and political pressures, then, may somewhat slow the migratory flows. But the incentive for immigration, from low-income and politically unstable regions in particular, will not vanish. Neither will the immigration itself.

5—Recalibration, not retreat

So does Brexit spell the end of globalisation? As we have seen, a significant shift in the trajectory of international integration was underway even before the referendum.

The phase where global merchandise trade grew faster than global output had already come to an end, because of the passing of supercharged Chinese growth, and of a distinctive phase of rapid development in global supply chains. The hyper-globalisation of financial markets, which created as many problems as it solved, slowed as regulators clamped down on risky cross-border bank lending. And, contrary to widespread belief, the rate of growth of the global immigrant population had already slowed, reflecting tighter border controls in some countries and better growth prospects in others.

So if by globalisation we mean an era when flows of merchandise, capital and labour across borders grow several times faster than GDP, then we can say that this phase in global affairs is already over. But if we mean a state where national economies are linked together by those flows—subject to adjustments as different countries see fit—then globalisation remains firmly in place.

The UK government will now seek to negotiate and implement new restrictions on the movement of workers into the country, the mandate it takes from the referendum. But it remains committed to free trade. New International Trade Secretary Liam Fox has been globe-trotting and bullishly talking about a post-Brexit Britain as trading even more freely than before—indeed he even predicts it could achieve “even freer” trade with Europe from outside the EU. The government is committed, too, to preserving the City’s position as an international financial centre, which will mean maintaining and even enhancing the freedom of residents and foreigners to move money in and out of the country. Whether it will achieve these goals, which will require agreements with foreign governments, only time will tell. There are reasons to be sceptical. But if it succeeds, Brexit will be seen as a recalibration rather than a retreat from globalisation—which in a sense is the same transition the rest of the world is also going through.

Barry Eichengreen will be a panellist at the Prospect debate: Brexit: Whither Globalisation? taking place on Wednesday 2nd November at 6:30pm.