In the two decades that the euro has been around it has been branded as hopelessly and inherently flawed, a failure, and a tragedy for Europe. Its critics have blamed it for many things—from soup kitchens in Athens, to wild gyrations in the markets, and the arrival of angry populists in Rome.

Yet for all the charges, Europe’s single currency, and the European Central Bank (ECB) which manages it, are still here. No other institution has more influence on Europe’s future than the ECB, and there is no obvious alternative to it. For better, or—very often—for worse, it has dictated the single currency’s story since its creation. You can’t fairly appraise the euro—which Britain never joined, of course, but whose fate will have important consequences for us even after Brexit—without taking a view on the central bankers who manage it. And those central bankers, especially Jean-Claude Trichet, who headed the bank from 2003 to 2011, must shoulder much of the blame for Europe’s sluggish recovery, and the disturbing rise of nationalism.

IN THE B€GINNING

Central banks take time to establish themselves, and—at 20—the ECB is young. Today the world’s markets hang on every word of America’s Federal Reserve, which seems as permanent as anything in the world of finance. But the Fed’s birth, in 1913, was mired in controversy; when it turned 20, in 1933, the US economy was in the grip of the Great Depression, which makes today’s eurozone look like a picture of health. Indeed, if one goes further back, the rows surrounding the First and Second Bank of the United States—which were respectively railed against by Thomas Jefferson and Andrew Jackson—are a reminder that institutions charged with the governance of money always court controversy. Capitalism and democracy can make difficult bedfellows and central banks are caught in the middle.As the issuer of currency, central banks are the lender of last resort both to high street banks and, at least normally, to governments too. They are thus expected to manage not only money, but also—effectively—exchange rates, public debt, the stability of the banking system and inflation. Furthermore, since wage inflation is linked to employment, they also have to monitor the labour market. Any action or inaction creates winners and losers. They may declare themselves “independent” of elected government, but central banks are inescapably political.

In the case of the eurozone, the difficulties are all the greater because it is the central bank for an economy the size of a continent, made up of regions as diverse as Belgium, Bavaria and Basilicata, without the fiscal or administrative apparatus of a nation state to back it up. The ECB rests atop a network of national central banks whose loyalties are inevitably divided between the eurozone and their national financial systems.

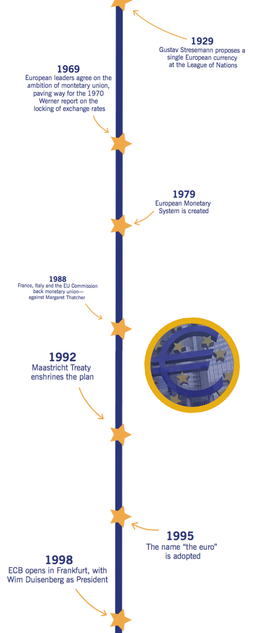

But that is only half the story. The euro was initially designed to contain the dominant influence that Germany’s central bank used to wield. To maintain their pegged exchange-rate against the mighty Deutschmark, the other central banks often had to march interest rates up and down in line with the Bundesbank. So they saw an obvious attraction in pooling control in a transnational institution. For the Germans, the formation of a European monetary system reduced the upward pressure on its currency, which could otherwise have threatened the trade surpluses on which Germany prides itself.

The ECB was placed—from the beginning—in the crossfire of European national identities and conflicts. The single currency was born out of a compromise between France and Germany. Chancellor Helmut Kohl wanted to bind Europe irrevocably together, limiting the scope for nationalist politics at home in Germany and elsewhere. François Mitterrand’s France wanted not only to dilute Germany’s dominant role over monetary policy, but also create an economy on a scale that would allow some wiggle room for domestic social policy in an era of globalised capital. The national horse-trading was built into this transnational entity: if the ECB was going to be based in Frankfurt, argued France, then it needed to have a French boss. They agreed on Wim Duisenberg, a Dutchman, only when it was promised that a Frenchman would follow him.

_________________

More from Adam Tooze:The secret history of the banking crisis

_________________ The ECB opened for business on 1st June 1998, seven months before the member currencies were irrevocably locked together to create the euro in electronic form, and three and a half years before the notes rolled off the presses. From the off, political conflict shaped the new bank. In pursuit of a dream of an ever-closer European union, many economists warned, member states were abandoning the sometimes useful option of national devaluations. The alternative to reducing a currency’s value is to adjust the economy to competitive pressures—in practice, that typically means wage reductions. It is pretty toxic for bankers to be seen as imposing those—especially if those bankers are German. Rather than bringing the Europeans together, as was the plan, a common currency that imposes asymmetric adjustment costs can thus descend into an orgy of mutual recrimination.

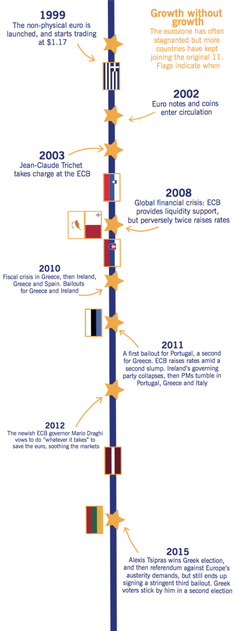

These are the dangers that lie deep in the structure of the eurozone, frailties that would make it an ambitious project under any circumstances. But the organism of the single currency at 20 years old has been shaped at least as much by its environment, as its original nature. What knocked the eurozone off its growth path 10 years ago was not the chronic lack of competitiveness in Greece or Italy, or the difficulty of adjusting to that, but rather the global financial crisis of 2008. And how the eurozone reacted to that challenge was a matter of political choice—decisions made by national governments, and above all the ECB. And the ECB’s performance was shockingly bad. We cannot blame this on unfortunate institutional structures. It was a matter of deliberate choice.

SHOCKING D€CISIONS

When the first shocks struck in August 2007, the ECB offered Europe’s banks a huge injection of liquidity—and then began pointing fingers. The ECB blamed the Fed and the Bank of England (BoE) who were in charge of the markets where the worst risks had been taken. Trichet, the conservative French Treasury bureaucrat at the head of European monetary policy, was incredulous that the Americans had allowed Lehman Brothers to fail. But Europe had nothing to crow about. Its own banks were even more oversized, and their balance sheets full of even greater risks. Under the so-called Basel II banking regulations, Europe indulged in an absurd faith in the self-insurance and the risk management of the private banks.In 2008 it fell to national governments to bail out the banks, and they took the flak. But the liquidity support that the ECB pumped in was no less crucial. The cash Trichet provided flowed back into the coffers of national governments as the banks used it to purchase supposedly safe government bonds. Trichet’s crisis-fighting in 2008-2009 thereby tied Europe’s banks and governments closer together, even while preserving the appearance of normality.

It was when the sovereign debts themselves threatened to go bad in 2010 that the game changed. Faced with a fiscal crisis first in Greece, then Ireland and Portugal, with Spain and Italy looming in the background, the ECB swung into action. From 2010, it became an aggressive and assertive actor in the struggle over the politically charged question of Europe’s future financial constitution.

______________________

The formation of the Euro

______________________ One might well ask how very small countries like Greece and Ireland could have such a disproportionate impact on the eurozone’s giant economy. “Contagion” in the bond market is the standard answer. But epidemic metaphors are misleading. Bond market contagion is not a natural phenomenon. It can only spread if the central bank for some reason refuses to do what the Fed, the BoE and the Bank of Japan have always done as a matter of course: stand behind the debts of the sovereign. Despite issuing trillions in new debt, none of these countries suffered a bond market panic. The difference in the eurozone was the ECB’s refusal to play that essential stabilising role.

True, the ECB was, to calm Germany’s historic fear of inflation, by design barred from directly buying newly issued debt. But in 2010 new debt was not the problem. What the ECB needed to do was to manage the giant market for outstanding bonds. Rather than putting a floor under that market, Trichet dipped in and out. It was a deliberate tactic. When the eurozone governments took steps towards fiscal discipline, Trichet backed them up in the market. When they appeared to be backsliding, he pulled out and let the markets rip.

The ECB often deals with critics by pointing to its limited mandate. But in responding to this crisis, Trichet far overstepped those bounds. His aim was nothing less than regime change. He was trying to use the crisis to force the completion of the still-incomplete constitution of the single currency zone—on conservative terms. He wanted Europe’s politicians to agree to binding fiscal rules, to establish a bond market stabilisation fund independent of the ECB, a fund that would keep the ECB forever clear of any obligation to stand behind public debt. Until the politicians fell into line, he would support the market only in extremis. Playing with fire, the ECB unleashed a conflagration.

When in the spring of 2011 Greece’s centre-left Pasok government suggested that it might be safer to write down or restructure some of its debt, Trichet did not just stonewall—he sought to silence the debate by threatening that if Athens publicly broached the issue, the ECB would cut off the funding lifeline to its banks. In the name of protecting the reputation of Europe’s sovereign borrowers, Trichet made himself into an intransigent defender of creditor interest.

And when market pressure was not enough, Trichet did not hesitate to step across the boundary that notionally separated the central bank from national governments; he issued instructions to the governments of Ireland, Spain and Italy, demanding spending cuts, tax increases and changes to labour law that reached deep into their internal affairs. Trichet used the ECB’s “independence,” and the threat of the bond market, to dictate terms to elected governments.

No such tough medicine was dished out to Europe’s banks, which should, like their American counterparts, have been forced to recapitalise in 2008-2009, even if that meant shareholders had to suffer. When the debts of Ireland’s banks threatened to tip its government over the edge, Trichet still refused point blank to countenance “bailing in” their private creditors to sharing the pain.

Was Trichet driven to do all this by the Germans? It will be some time before the archives are opened. The evidence certainly suggests that he was constrained by the German members of his board. Jürgen Stark, his chief economist, is widely blamed for the extraordinary decisions both to raise rates in 2008 and then again in 2011. And whenever Trichet did enter the bond market, he could count on protests from the Bundesbank, an institution that retained some clout, even after most of Europe’s central banks had been reduced to conveyor belts for ECB policy.

But the Germans are just one voice: as the next governor, Mario Draghi, would later demonstrate, the ECB does not have to genuflect to them. Besides, Angela Merkel needed the ECB to fix the European problem, as much as the ECB needed Berlin. So German opposition could have been finessed. But rather than counterbalancing, Trichet tended to amplify German conservatism. On debt restructuring, the roadblock was the ECB, not Merkel or her finance minister Wolfgang Schäuble, who were far more willing to broach the question than Trichet. They wanted discipline all around—for bankers and reckless investors, as well as taxpayers. The euphemism de jour was “Private Sector Involvement,” which meant a “haircut” for bondholders. Germany’s political leaders had a solid democratic mandate for demanding that. The German public hated the bailouts and wanted the bankers to pay, even their own. Trichet, by contrast, was soft on bankers and creditors, while egging on the markets to discipline national governments and their citizens. This unappetising mixture was no mistake or miscalculation. It was a deliberate, high-stakes gamble, by a group of conservative technocrats that has left Europe scarred.

After an autumn of crisis that claimed the scalps of the elected Prime Ministers of Spain, Italy and Greece, in December 2011 the European Fiscal Pact gave the conservatives the institutional win they wanted. On his way out of office, Trichet had helped Berlin to hardwire austerity into the circuit board of the EU. It was a political victory that has curbed fiscal policy as an active tool of economic governance. It thus contributed to Europe’s agonisingly slow recovery and low rates of public investment.

WHAT€VER I SAID

With his MIT training, Trichet’s Italian successor, Mario Draghi has more expansionary, freewheeling instincts than Trichet. But Draghi’s fiscal instincts are conservative. He co-signed Trichet’s fateful missive to Berlusconi in August 2011. If he was free to adopt a more interventionist stance, it was in part because Trichet had done the dirty work of beating Europe’s governments into line.When Draghi made his dramatic pronouncement in July 2012, promising that he would do “whatever it takes,” he turned the ECB from the villain into the saviour of the euro. He spoke against the backdrop of a renewed crisis in Spain, and fears about Italy and Greece. But Draghi made those remarks to hedge fund investors in London not so much out of desperation as exasperation. As he remarked to a friend, the Anglosphere’s incurable obsession with the end of the euro, “sucked.”

The doubters in the City of London did not understand how far Europe had come. Not only had Europe agreed to a banking union, but—however bruising the negotiations, and however deflationary the result—it had also managed to hammer out a fiscal framework. So Europe was evolving, and the commitment of its governments was far too large to be wound back, even in the face of the long period of ECB intransigence.

Of course, the price paid for the ECB’s victory was huge. The shock of 2010-2011, followed by a severe dose of austerity, tipped the European economy into a prolonged second recession. No one doubts there are many unproductive businesses in Italy and Greece that are plagued by chronic underinvestment, but their current misery and acute sense of helplessness owes more to the way their economies have been run with anaemic demand. Even if market liberalisation really is required, that would be far easier to pull off if the economy is humming and labour markets are tight.

The trans-Atlantic contrast is painful. Ben Bernanke’s Fed welcomed Obama’s second presidential term in November 2012 with a huge surge in bond buying: Quantitative Easing 3—aka “QE to infinity.” America’s central bank announced that it would not even consider raising interest rates from zero until unemployment had been brought down to 6 per cent. By contrast, the ECB allowed its own balance sheet to collapse. Credit and investment contracted. Bad debts piled up. As a generation of school leavers and graduates found themselves locked out of the labour market, youth unemployment in the hardest-hit eurozone countries soared towards 50 per cent. The political scene was in uproar, with left and right-wing critics of the euro and the ECB on the march.

It was not until 2015, when the risk of outright Japanese-style deflation hit, that the ECB finally put the foot on the monetary accelerator. In March 2015 it embarked on QE on a massive scale, more than doubling its balance sheet by 2018. Most immediately, this surge in liquidity provided some modest support to Europe’s recovery. But its political ramifications, by way of the bond market, were far more dramatic. QE insulated the eurozone against any contagion from the renewed Greek debt crisis in 2015. As Syriza took Greece to the edge of disorderly default, in the rest of Europe it was as if nothing had happened. There isn’t much risk of “contagion” when the ECB is draining the markets of available bonds to buy. Here is proof that the entire sovereign debt crisis of 2010-2012 could have been avoided if Trichet had not chosen, deliberately, to take Europe to the brink.

Even under Draghi, ECB protection comes with conditions. To qualify for ECB purchases, sovereign debt has to have an investment grade credit rating. Thus even as it dominates the bond market, the ECB allows its own conservatism to be ventriloquised by the ratings agencies. Portugal’s left-wing coalition government hangs by the thread provided by one solitary investment grade rating. Italy will be subject to the same pressure if its new cabinet deviates any further from the path of respectability.

FLAWED P€OPLE, FLAW€D POLICY

Reviewing this remarkable history one is forced to the question: Why can the ECB exert such influence over Europe’s destiny? The answer is that, to all intents and purposes, joining the eurozone is irrevocable. The UK is slowly discovering to its cost what “taking back control” entails. A departure from the euro would be more immediately disruptive of day-to-day life than even the hardest Brexit, because it would make itself felt at every cash machine, and money can move faster than patterns of trade.Economists continually second guess the euro’s survival, but few politicians in Europe will seriously discuss it. And when they do, it does not prove popular with the public. When shown the exit in 2015, the Greeks chose to remain. Though they voted to reject the unreasonable terms set by the eurozone creditors in a referendum, when Prime Minister Alexis Tsipras nonetheless cut a deal to keep Greece in the club, far from being punished, he was returned to power with an identical share of the vote. The alternative is simply too horrible to contemplate. The turmoil in Rome, which has handed power to the unpredictable Five-Star and the chauvinist League, has more to do with immigration than the single currency, which—by two to one—most Italians still want to stay in. Outside the areas of immediate crisis, the Eurobarometer poll records 80 per cent approval ratings for the euro.

This ought not be surprising. Even at the height of the crisis, across the eurozone 87 per cent of adults were in work, mostly enjoying modest increases in income. The Germans and the Dutch have done very nicely. Hot spots like Paris are still basking in the afterglow of a real estate boom. Since 2006 seven additional members have sought the protection of the world’s second most important currency—Slovenia, Slovakia, Malta, Cyprus and all three Baltic states. With the UK on the way out of the EU, Brussels makes no secret of its aim to make the euro the common currency of the entire EU. And when Europeans glance at the travails of neighbours who have kept their own currencies, pre-eminently just now Turkey, this pro-euro sentiment is likely to be reinforced.

Meanwhile, misery has been concentrated in pockets of chronic unemployment, on the “southern periphery,” above all among the young. Their votes have impelled the rise of protest parties. But those that have come to office have so far flinched from the ultimate confrontation. There is simply too much at stake.

Even if there is no alternative and the only way out really is catastrophic, this does not mean that there are no choices. What the first 20 years of the euro show is that choices matter a great deal; it is just that most of those choices are concentrated in the hands of the central bank. If the description of the euro as a tragedy is overblown, the insistence that it is a tragedy which flowed inevitably from its design flaws is even more so. The financial crisis in 2008 was the result of very real failures, but failures of governance common to western capitalism as a whole. The disastrous European reaction that followed was a matter of choice. The ECB leadership chose to exploit the crisis to force the pace of fiscal consolidation. Whatever the euro’s design flaws may have been, it was this aggression that produced one of the most serious derailments of economic policy in modern history.

Under Draghi, things have been more tolerable, because he has offered substantial monetary relief and—with conditions—been ready to protect governments from the bond markets. But the ECB’s fundamentally conservative constitution remains in place. Why, given Europe’s sluggish demand and need for investment, are Europeans willing to accept a central bank which, unlike the Fed, is only tasked with controlling inflation? If Bernanke and his successor Janet Yellen could also target employment, why should the ECB not be expected to manage a similar feat? If China’s regime understands the link between growth, jobs and legitimacy, and sets credit policy accordingly, why does Europe persist in denying the obvious?

Institutions matter, but people make policy. The story that posterity will eventually write about the ECB’s first 20 years will depend on the next moves. Draghi is coming to the end of his term, as are others on his team, like Benoit Coeuré. Who replaces them is key. With the conservative Bundesbank president, Jens Weidmann, in the running, it is possible to imagine a drift back towards the Trichet line, with all the old tensions rising again.

Nor is this only a matter for Europe. With the increasingly nationalist tide in American politics, it seems fair to wonder whether the Fed would be able again to serve as a stabilising anchor for the global financial system, as it did during the last crisis by providing foreign central banks with the dollars they needed to keep the system in business. Many ordinary Europeans may be content with a euro managed by Draghi. But at some point, the whole world may need Europe to act as a more assertive and creative force on global monetary policy too. After the travails of its first two decades, it may very well doubt whether Europe and its central bank are up to that global challenge.

Who opted in when?