The Trump administration is hellbent on disrupting the system of economic governance that is globalisation, and is doing so with a vehemence that constitutes outright vandalism. The president’s erratic and self-serving executive orders; his high trade tariffs and new trade wars coupled with attacks on allies have undermined trust in the world’s reserve currency, the US dollar.

One-sided tariffs will not tackle the cause of US imbalances—which cannot be understood in isolation. These imbalances are global, existing between countries with trade (also known as “current”) and capital account surpluses and deficits. And trade imbalances are a function of financial inequality. To fix trade imbalances requires standing up to Wall Street and taxing cross-border capital flows. Trump has no intention of doing that.

Fixing the system as a whole and raising the living standards of Americans “left behind” by globalisation will require international coordination and symmetric policy responses to the world’s surplus and deficit countries. In other words, it would take US leadership to resolve what the economist Dani Rodrik calls the contradiction between national sovereignty and financial globalisation. But Trump is no statesman. He is incapable of exercising international leadership. On the contrary, he is determined to create new enemies, to make enemies of old allies and to build alliances with authoritarian, war-mongering nationalists.

Even so, it would be wrong to deny that, in their distaste for the global liberal order, Trump and the 77m Americans who voted for him have a point. Globalisation has generated economic and ecological disorder, enriched the already wealthy and cut the living standards and economic security of billions of people, including Americans.

It is a liberal system of global governance backed and fortified by the richest 10 per cent of the world’s population because it sustains not only their pensions but their inflated housing wealth. The richest 1 per cent—those invested in the City of London and Wall Street—owe much of their unearned wealth to deregulated and financialised globalisation, which Richard Kozul-Wright and Kevin Gallagher have called “an international economic regime, fully tuned to the demands and wishes of footloose capital” in their book Restoring Multilateralism.

Not so for the 90 per cent, including most young people. In 1971, the year President Nixon dismantled the Bretton Woods rules-based order that had delivered a “golden age” in economics, US workers shared 51 per cent of the nation’s annual income, or GDP. By 2023 that share had fallen to 43 per cent. In 2021, America’s richest 1 per cent of households averaged 139 times as much income as the bottom 20 per cent, according to the Congressional Budget Office.

Over the past three decades, the US’s most affluent families have added to their net worth, while those at the bottom have dipped into “negative wealth”, as their debts exceeded the value of their assets. During the Covid-19 pandemic, from 18th March 2020 to 15th October 2021, the combined wealth of all US billionaires increased by $2.071 trillion (70.3 per cent) to $5.019 trillion. The US has more than 700 billionaires, and the combined wealth of the five richest—Jeff Bezos, Bill Gates, Mark Zuckerberg, Larry Page and Elon Musk—rose by 123 per cent in that time.

Such obscene levels of inequality are not confined to the US. According to Thomas Piketty and colleagues, the richest 10 per cent of the global population takes 52 per cent of global income, while the poorest half earns 8.5 per cent of it. The richest 10 per cent of the global population owns 76 per cent of total wealth, while the poorest half owns just 2 per cent.

To avoid more trade wars, and ultimately a real war, something must be done. There is no point in standing back—as John Bolton advised in this magazine’s previous issue—and hoping that in 2028 Trump will be defeated and the liberal world order restored. Globalisation has been widely discredited, and the system is so unstable and unbalanced that it will continue to generate both economic and political crises if it is not transformed.

There is no room for defeatism and complacency in the face of these challenges.

The United Kingdom bears some responsibility for today’s disorder, because the roots of globalisation lie in British economic liberalism and 19th-century imperialism.

The theoretical foundations of today’s economic system were laid in the late 18th century by Adam Smith and David Hume. They used the liberal idea imported from Spain and France—where political notions of liberty had no connection to free market theory—to describe their favoured theoretical free market system. The British version fused the political ideas of rule of law and civil liberties with the economic maxims of free trade and free markets.

This unique and ultimately revolutionary fusion of political and economic ideas was driven first by innovations in British monetary policy that aided investment abroad, and second, by sterling’s role as the world’s reserve currency. The growing prestige of the Bank of England, the military power of the state and the dynamism of the City of London helped power, protect and finance Britain’s 19th-century exporters.

The conditions outlined above prepared the ground for the emergence of Britain’s great imperialists, embodied by Cecil John Rhodes, who, to protect his South African wealth, engaged the British state in the futile and costly second Boer War.

JA Hobson, an economist whose reputation is tainted by his antisemitism, was the Guardian’s correspondent during the Boer War and analysed the UK’s liberal 19th-century global trading and financial system in his 1902 book, Imperialism. Britain’s rich, he argued, preferred not to invest in the market at home. Instead, bolstered by the power of unregulated capital mobility, export subsidies and tax breaks, they invested their surplus wealth abroad, in countries such as South Africa, where wages were low and land cheap. That led to increased production—but low incomes both at home and abroad meant consumers did not have the purchasing power to consume that production. And so, aided by the mobility of cross-border capital flows, investors searched for even more foreign markets on which to dump surplus production.

With time, the 19th-century version of globalisation took hold.

As more and more of the UK’s wealth was channelled abroad, the toxic combination of inequality and imperialism raised political tensions, much as they do today. Only 12 years after Hobson’s book was published, the UK and the world were plunged into a catastrophic world war.

Today, in Trump’s America, Apple’s Tim Cook, Tesla’s Elon Musk and Nvidia’s Jensen Huang have profited immensely from globalisation. While their businesses differ, the modern plutocrats share with their predecessors a preference for channelling investment and production into low-wage countries such as China, Vietnam and India, and to direct their profits into low-tax domains such as Ireland.

China’s equivalents are the heavily subsidised and state-backed corporations that churn out goods and channel them into markets in North America, Europe and Africa.

Wealth in China is also highly concentrated. The richest 10 per cent of the population hold approximately 67 per cent of the country’s wealth. The top .001 per cent owns 5.8 per cent of it, about the same as that owned by the bottom 50 per cent.

The share of China’s national income earned by the richest 10 per cent of the population increased from 27 per cent in 1978 to 41 per cent in 2015, while the share earned by the bottom 50 per cent (now around 536m adults) fell from 27 per cent to 15 per cent.

Trade wars, argue the economists Matthew Klein and Michael Pettis in their book Trade Wars Are Class Wars, originate with inequality at home: in conflicts between wealthy, subsidised, low-taxed exporters of capital—the 1 per cent—and the majority within a country who are enduring falling or stagnant incomes and rising levels of taxation.

In the US (as elsewhere) those tensions have been exploited by the Trump team. It heaps blame for inequality and falling living standards on foreigners—Mexicans, Chinese and even Canadians—rather than on the oligarchal, tax-avoiding superrich.

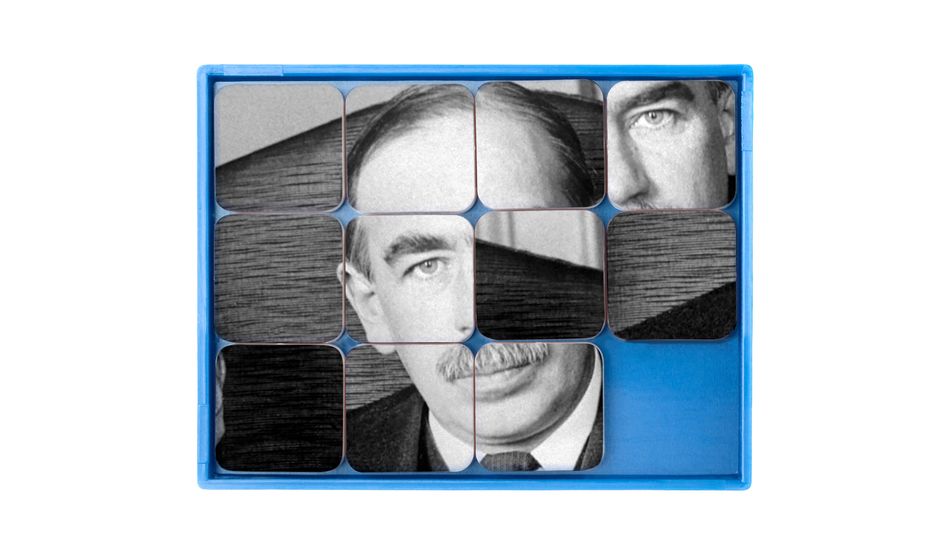

It seems fair to say, as John Maynard Keynes did in 1933, that decadent international but individualistic capitalism has not been a success. The protectionist tariffs imposed by the Trump administration are a wake-up call “that the contradictions and tensions in the system are unsustainable, extending well beyond trade rules”, as the Brookings Institution, a thinktank based in Washington, DC, notes.

To reverse the rise of protectionism, nationalism and authoritarianism across the world—and restore stability, sustainability and prosperity—it will be necessary to restore political, democratic liberalism. Above all, political leaders will need to commit to a new spirit of internationalism and to building a cooperative and coordinated economic world order.

A more balanced system at home and abroad requires state intervention

A new stable international order can only be achieved by ending inequality; by rebalancing economic and political power between capital and labour, between wealth and work, at home and abroad. Constraints on cross-border flows of both capital and trade are key to the restoration of global stability, and these flows cannot be left to the whim of markets and allowed to once again balloon out of control.

A balanced global trading and financial system allows for sound investment towards tackling climate breakdown, creating jobs and raising incomes and purchasing power at home. We know such a system can be established, because the one built in 1944 sustained that “golden age” of economics for more than 30 years.

A more balanced system at home and abroad requires state intervention—to protect markets in goods, services and money, not to oppose the market. Above all we need a Big Green State to protect the biosphere. And because of the threat of climate breakdown and ecosystems collapsing around the world, policies for national self-sufficiency must be preferred. We must prepare to live sustainably within our means, and not beyond them.

Keynes was haunted by the role that Britain’s gold standard currency, sterling, had had in fuelling the economic failures of the 1920s and 1930s, which in turn led to a catastrophic war. He began working on an alternative to a hegemonic reserve currency in 1941, and three years later presented his plan for an International Clearing Union (ICU) to the House of Lords. He said its purpose could be explained in one single sentence—it would ensure that “money earned by selling goods to one country can be spent on purchasing the products of any other country”. It was as simple as that.

The ICU is in essence a trading union disguised as a banking union. It would enable states to engage in international trade using their own currencies. Their trade surplus, or deficit with another state, would be managed in much the same way a central bank manages the accounts—the daily surpluses and deficits—of commercial banks. Countries in deficit would be granted an “overdraft” but would be disciplined. Countries could build up a surplus, but there would be penalties on big surpluses to oblige countries to keep trading. There would be no need for a currency. The equivalent of the central bank at the heart of the trades would keep an account of surpluses and deficits and apply penalties to imbalances.

An ICU would encourage more trade between states, Keynes thought. We know he was right because when a regional ICU was adopted in Europe after the Second World War, it played an important role in Europe’s recovery.

And yet, at the 1944 Bretton Woods conference, the economist Dennis Robertson, who was a colleague of Keynes, happened to be responsible for an amendment to the Final Act of the Articles of Agreement. Late one night, and unbeknown to Keynes, Robertson, backed by the US Treasury’s Harry Dexter White, ensured that official gold subscription by a country to the new Bretton Woods system would be expressed as official holdings of gold and United States dollars. It was a profound betrayal of Keynes’s wartime work.

Since then, a strong dollar has worsened US trade balances over the years. It has harmed the interests of poor countries obliged to purchase oil and pharmaceuticals in a currency always stronger against their own. It has inflated unsustainable sovereign and private debts. Ultimately the strong dollar weakened US manufacturing while enriching Wall Street. It helped power Trump’s second election victory.

Sceptics of the dollar’s role as the world’s reserve currency do not have a sound alternative to the current international system. Keynes’s plan is often dismissed as utopian, but it is in fact the answer to the dystopian age we are currently living through.

With sound internationalist political leadership, the system can be transformed. We know it can be done because it has been done before. It is not too late to listen to Keynes.