For thousands of years gold has been treasured and collected. But in the 21st century is there any point holding it as part of your investment portfolio?

Gold fans have long argued that it offers an insurance policy for investment portfolios. “Gold tends to do well when other assets fall,” says Adrian Ash, head of research at gold trader BullionVault. Investors fall back on this rare and precious metal for its intrinsic long-term value and safe haven attributes.

“Some people will argue gold cannot be valued, and thus has no intrinsic value because it has virtually no industrial use, is inert and it generates no cash,” says Russ Mould, investment director at AJ Bell. But, that is also what gives gold its value. It has no secondary use other than as a safe haven investment, so tends to be unaffected by factors that can upset other investments. Further, gold carries no “counterparty risk”: a company that issues shares or bonds can go bust, leaving the securities worthless; a bank can go under, wiping out depositors’ cash. But gold does not rely on any entity’s solvency to underpin its value.

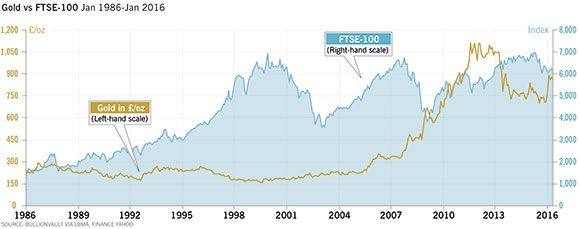

However, it can be a volatile investment, as investors have seen in the past five years when it has fallen back from a record high of $1,800 an ounce to around $1,280. “Gold investments aren’t for the faint hearted,” says Danny Cox, from stockbroker Hargreaves Lansdown. But over the long-term it has performed well, the price rising almost 300 per cent in nominal terms over the past 30 years.

“The bottom line is buy a little gold, and hope it goes down,” says Ash. If gold falls that usually means the markets are performing well and confidence is high so the rest of your portfolio should be rising. But, if times get rocky that gold should help reduce your losses.

If you do decide to add some gold to your portfolio there are a number of ways you can do it. You could opt to invest in gold mining firms, an exchange-traded fund (ETF) or purchase physical gold.

Gold mining stocks and funds bring in a lot more risk than just gold as your investment will also be affected by how the mining company itself performs. They “bring credit, political, equity and management risk,” says Ash. But, they can also outperform gold if the miner is having a good year. The issue to consider is why you are investing in gold. If you are seeking a safe haven, gold miners are best avoided as it is the bullion price that tends to rise as investors secure their money during a crisis, rather than the mining stocks which can be affected by shocks to the stock markets.

ETFs are a good cheap way to gain exposure to the gold price and mean you can put gold in your ISA too. ETFs that track a commodity such as gold are known as exchange traded commodities (ETCs) and usually track the gold price with a small fee of 0.25 per cent to 0.5 per cent. Two of the most popular are ETF Securities Gold Bullion Securities and iShares Physical Gold.

The final option is to own the metal. This has some tax benefits but raises the question of storage. Be careful before you start putting gold bars under your mattress, even the smallest amount of gold may not be covered by your home insurance unless you keep it in a safe approved by your insurer. Many gold traders, including the Royal Mint and BullionVault, offer secure storage. You’ll pay a fee for this but it is likely to be less than the hike in your insurance premiums.

Holding physical gold also has some tax benefits. Gold coins and bars can be purchased VAT-free and gold coins are exempt from capital gains tax. Also consider the costs associated with buying different sizes of physical gold. “Smaller bars attract a higher premium than larger ones due to the manufacturing costs associated with production, so it’s more cost effective to invest in larger quantities,” says Howard.